Finding a better credit card that gets you rewards, and discounts for your eligible purchases and also improves your credit score behind the scenes feels like finding a needle in the haystack, as there are a myriad of credit cards available.

You will be lo and behold after realizing that once a credit card that was giving you handsome rewards, perks, and building your credit score amidst the journey is not at your service now, as it’s now been taken over by any other company.

Some people might not realize until they receive an official mail or message from the company or they realize while using the card somewhere that they can no longer avail of the services from the card.

Here, in this article, You’ll know almost everything about Ally Credit Card, as we are covering all the relevant content about it below. So, let’s dive into the topic without any further delay.

Login process for the Ally card:

If you already finished the application process, you have got an Ally credit card, and also you activated it. Then you can now have access to the card, moreover various account management tools such as bill payment, online bank statements, credit balance, etc, by just setting up login credentials.

This simple process will guide you to log in to your credit card account:

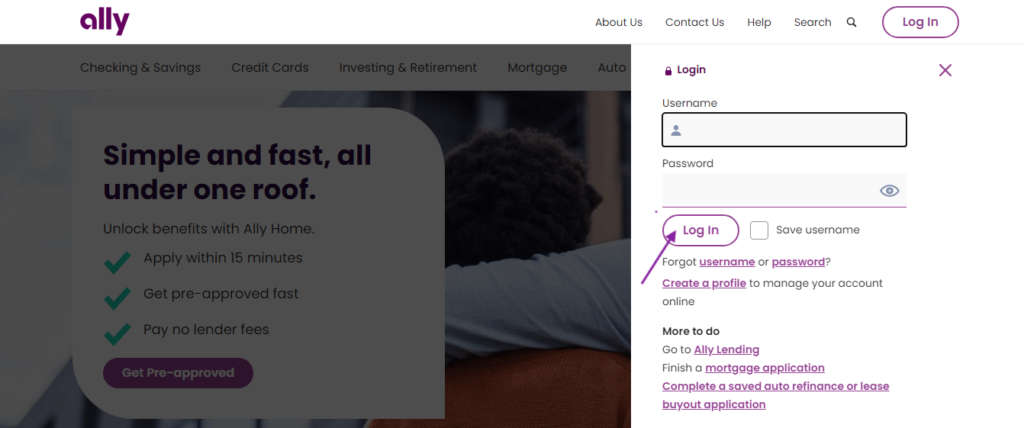

- Visit the Ally Financial Homepage.

- Just tap on the Login button in the top right corner.

- Enter your login credentials (username, and password) and hit “Login.”

- You have successfully logged in to your Ally account, which you can use to access the credit card.

How to set up your online access account?

This process helps you to access your credit card, moreover, you can leverage other Ally financial services. But, you should have your credit card activated already so that they can verify you easily.

Kick off your online account setup and verification process by following the sequential steps outlined here.:

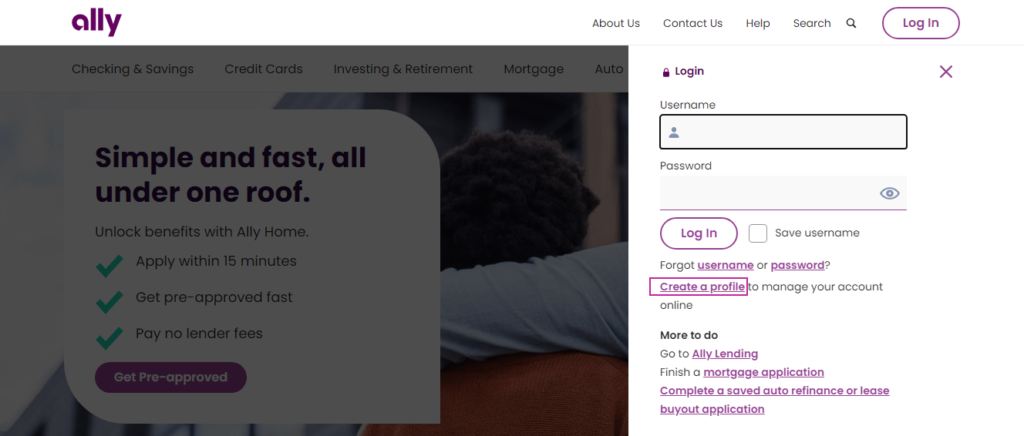

- Head over to Ally Financial’s log-in page once more.

- Click the “Create a profile” link just below the Username and password link as exhibited in the image.

- The system will ask about the account type, simply choose the “Bank, Invest, Credit Card, and Mortgage” link button.

- Provide your date of birth, and SSN, and click continue to verify yourself.

- You can execute the exact process by clicking “Enroll in online services” on the Ally Bank credit card homepage.

How to activate Ally’s credit card?

Here’s a quick process to activate the ally card:

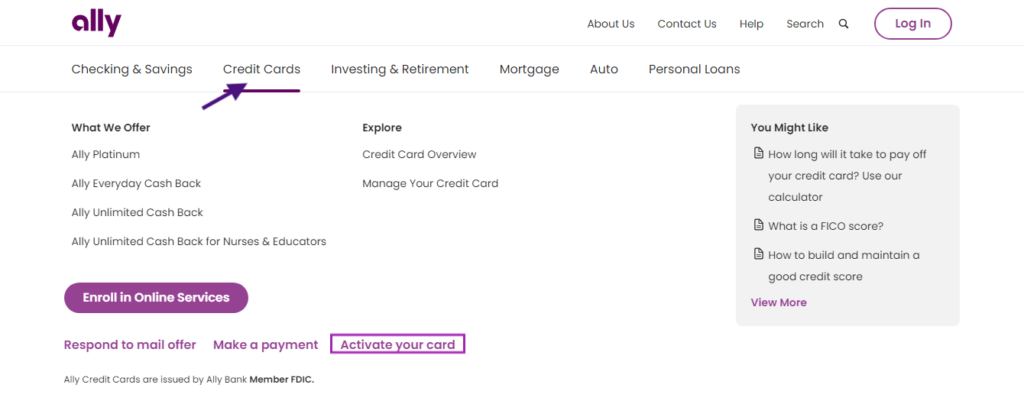

- Visit the homepage of the Ally credit card you did in the log-in and online account setup process.

- Click the credit cards tab and tap on the “Activate your card” link shown in the image.

- Enter your details such as last name, date of birth, 16-digit code of credit card, SSN, etc, and click continue.

The application process for the Ally credit card:

You can only apply by the “respond to a mail offer” option which means that if you have received a mail code, and for that, use these simple steps:

- Click the “Respond to a mail offer” link on the Ally credit card homepage.

- Submit the reservation number, and access code you received by mail.

- After appraising your eligibility they will send you an email with the related details.

Making Ally credit card payments:

Online: Making online transactions is a robust, transparent, and secure method that adds quick accomplishment of the Disburse funds, Plus, the transaction you make results in an update after a few minutes.

Log in to your Ally account’s credentials, and locate the Account summary > Make a payment to complete the process.

Pay by post: Another way you can pay your Ally card bill is by sending the money with a mail letter to their correspondence address. in case you don’t want to pay bills online.

You can send the money to the address below:

Ally Credit Card

P.O. Box 660371

Dallas, TX 75266-0371

Use an automated phone number: Call the 1-888-366-2559 number, and provide the required details of your credit card, and the automated assistant will help you to process your funds. This number is available 24/7 to aid you.

Enable Autopay: This method lets you rest assured about remembering yourself about paying bills as your payment will be paid automatically and at the right time, helping you save your prudence from those annoying late payment messages.

- Log in to your account and select payments > credit cards > Enable Autopay if you are using a web browser.

- You can also use the Ally app from the Google Play Store and Apple App Store, to enroll in Autopay, just log in, locate and click account summary, and search for the enroll in autopay term under the payments tab in your account management menu.

Ally card Customer Support

- You can send your general queries and concerns to this address:

Ally Credit Card

P.O. Box 9222

Old Bethpage, NY 11804

- Report any fraud complaint at this number 1-888-366-2559.

- An online access account enables you to contact additional support and account management tools, chat with the support team, and send secure e-mails to get online assistance.

About the Ally credit card:

What once provided services as the Ollo credit card until 2021, is now known as an Ally credit card in 2024.

Its issuer was the Bank of Missouri and the service provider was Fair Square Financial, now Ally Bank and Ally Financial have taken over the Ollo to start from scratch.

So, now that Ollo cards have become ineffective, you need to apply separately for the new Ally credit cards, before you do that let us unveil the benefits and the relevant aspects of the card.

Benefits of the Ally Platinum Mastercard:

- Relief in your pocket: Knowing the fact that you don’t need to pay any kind of foreign transaction fees, annual fees, over-the-limit fees, or returned payment fees, you can give yourself relief that they will not charge you additional fees for these activities. Also, you don’t need to bear a late payment fee other than that applicable.

- Absolute security benefits: Provided that the card comes with a Mastercard license you will get security terms such as zero liability charges, fraud monitoring, 24/7 customer care, Tap-to-pay convenience, and if your card gets lost you can lock it instantly.

- Frequent credit reporting: Reporting to the credit bureau agencies so, that you can have your credit line increase automatically if they think to make you eligible for a credit line increase, you can get a free FICO® score as well.

Ally Platinum Mastercard fees:

- APR (Annual Percentage Rate): The APR is variable and falls between 20.99% – 29.99%.

- Interest Charge: If they impose some interest charge it will not be less than $1.50.

- Balance transfer and cash advance fee: 4% or $5 will be the balance transfer fee and the cash advance fee will be 5% or $10. They will apply the greater for both terms.

You Might Also Like