Credit cards might be a better option if you want to pay for shopping, gas station bills, and groceries without causing any hassle to your bank account or your pocket.

Although you probably want to know everything about a particular credit card to step further, you might have a shortage of time to grind out all the details.

That’s why we strive to aid you with the details and actions of credit cards to save you some time.

Well, in this article, we have explained simple steps to activate a Destiny credit card, also we have gone over every possible point, so let’s not beat around the bush.

Activating Destiny credit card:

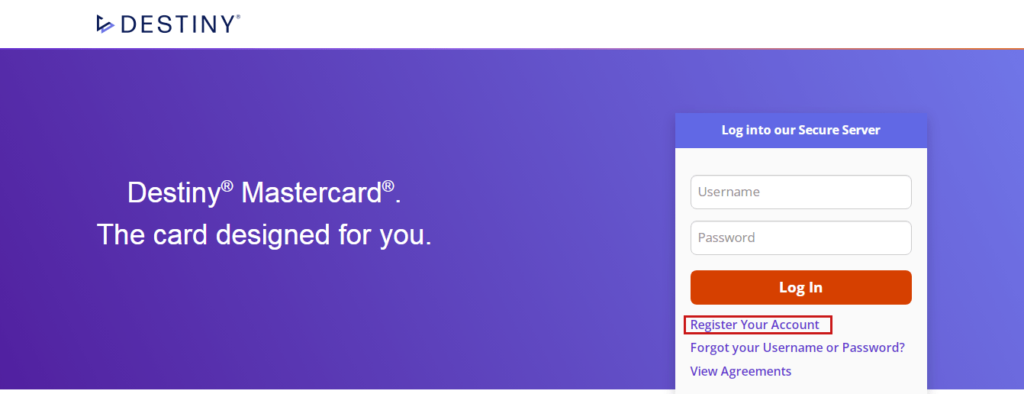

- Visit, the Destiny card activation page.

- Click the “Register Your Account” link.

- Enter your details such as your card number, date of birth, and SSN.

- Tap Continue to proceed.

- Keep providing details and adhering to the instructions in the further steps.

- You have successfully activated your card. In addition, you have made login credentials so you can access your credit card for online use.

Forgot username and password: If you have created your Destiny login account and mistakenly forgot your username or password. You can recover them by clicking the “Forgot your username and password” button.

So, you have the flexibility to reset both by providing some essential inputs.

How do I Log in? –

By logging in, you can use your Destiny card online for purchases, as well as you can pay your credit card bill which is a quick process.

Just follow these simple steps:

- Visit the link, you did when activating your Destiny credit card.

- Enter Log in credentials you created during the Destiny credit card activation process.

Destiny Card: Apply

In the current scenario, some banks send pre-received mail offers to the clients they feel eligible according to their income and expense data.

But, if you already haven’t received the mail offer, you can still roll the dice by applying online.

You can apply for the card through the process below:

- Head over to the Destiny credit card application page.

- Click the “Apply Now” button.

- They need basic to more essential information such as your name, SSN, date of birth, and income and expenses to better determine your eligibility.

- After you furnish your details, scroll down to the bottom of the page and hit “Submit application.” You can read all the terms and other information.

- They will review your application, and if they feel you are eligible and responsive, you can get yourself a Destiny card.

Apply through Mail Offer:

If you received a mail offer that means you are eligible to get their card. And once you submit the code you have gotten through the mail, your chances are primal than those who applied without any pre-received mail offer.

Let’s get it done right now by adhering to these steps:

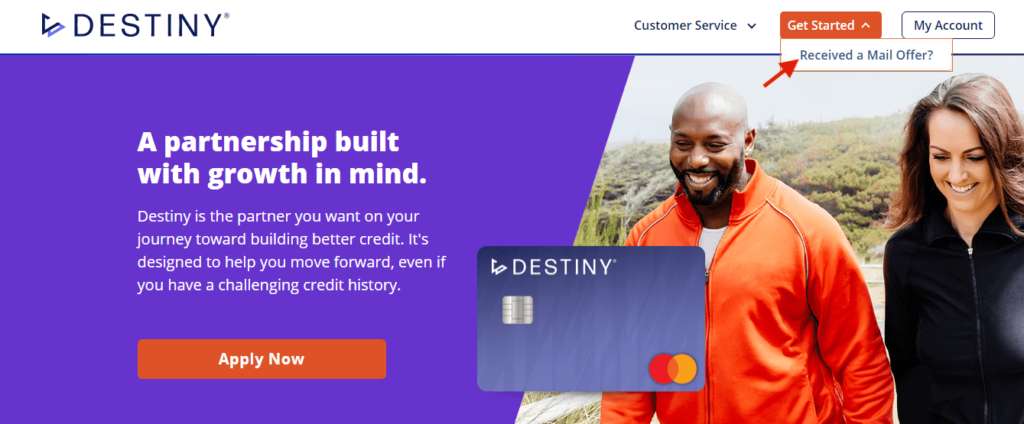

- Go to the homepage of Destiny Credit Cards, which you just did in the first step of the “application process” section.

- Then tap on the “Get Started” button located on the top right side.

- Tap the “Received a mail offer?” button as shown in the image.

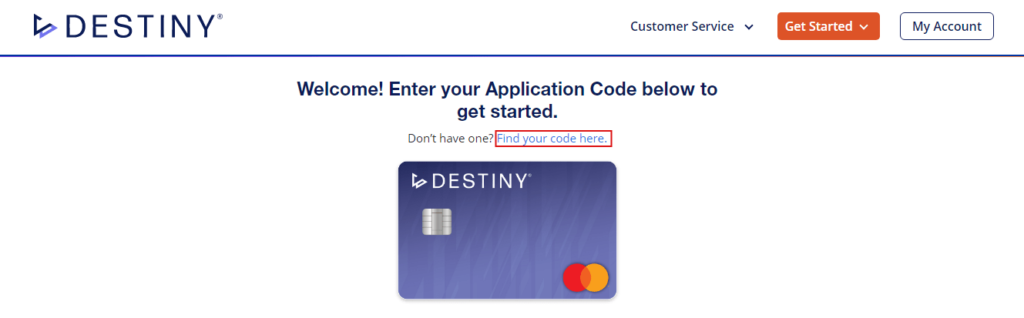

- Once the link is fully opened, provide the code from the mail, and your zip code, and click “get started.”

- As you are likely to get the card, your application’s scrutiny presumably finishes sooner than the others.

If you mistakenly lost the mail offer code, then you can find it through these steps:

- When you are on the page where you provide the mail code, scroll up a bit and click the “find it here” link just above the card, as shown in the image.

- Enter essential details such as your name, zip code, and SSN to find your code.

Destiny card bill payment methods:

You can complete the Destiny card bill payment through post mail, online, and by phone.

Pay online: This is the most convenient, secure, and fastest way to complete your pending bill.

You just need to log in to your Destiny card account, after that you can have the “Pay Bill” option under your account management options, and choose to pay through a bank account, debit card, and payment apps like Apple Pay, Google Pay, etc.

Send money by PO: If you prefer to pay in fiat money, you can post the money to this correspondence address:

Concora Credit | PO Box 96541 Charlotte, NC | 28296-0541

Pay by Phone call: You can contact the toll-free Destiny Credit Card customer service number to process the payment on your card. Call at 1-800-583-5698.

Remark: You can use the number for various contexts such as for payments, support, and information.

Customer support:

- Visit the official Destiny card page, and log in with your credentials. Now you can find the “Support” or “Contact Us” option under your profile management tools online.

- Use the customer support number 1-800-583-5698 to get help in different scenarios, so you can call this number to find answers to your problem without hesitation.

- You can use the 1-503-268-4711 FAX number for documentation purposes.

- Send them any concerns by post mail at the following address: Concora Credit | PO Box 4477 Beaverton, OR | 97076-4477

Destiny Mastercard: Alternatives

If you are looking for options like Destiny Mastercard, you can check out these:

About Destiny Mastercard:

The Destiny credit card’s issuer is First Electronic Bank while the services and programs manager is Concora Credit Inc. which holds the rights of “Destiny” title.

This card is designed to support low credit score holders, so they have peace of mind while using the card that they are actually progressing to a better financial state.

You can decide whether to get one or not by looking at these benefits:

- Helps you to build a better credit score.

- As it’s embedded with a Mastercard ® license, you can use it anywhere, the only term is they accept credit cards. It completely inherits all the security benefits and facilities of Mastercard.

- Reporting to all three major credit bureaus, so you rest assured about your credit score improvement.

- You don’t need to deposit any security transaction as it’s an unsecured card.

- Have peace of mind since your card is secure with 24/7 theft protection, and zero liability protection.

Crucial Points not to overlook:

You need to be aware of some crucial terms, conditions, and other important points:

- If you wish to sign in for Overlimit, the charge will be up to $41 if you surpass your credit limit.

- The purchases and cash advances APR for this card is 35.9%.

- You need to pay your bill within 25 days after the issuance of your next payment cycle to avoid a late fee if you in case you don’t manage to do so, they will charge you an interest of $1.

- The annual fee on your credit limit will be imposed as a “set-up and maintenance fee” which is $175 for the first year and $49 afterward. If you feel unpleasant with this, you can decline only if you neither utilized nor made any payments for the account.

- The cash advance fee is $5 or 5% which will relate to the greater from both.

- For each abroad transaction you have to pay $1 additionally.

- The penalty fee might vary according to your activity. However, it will not pass over the $41.